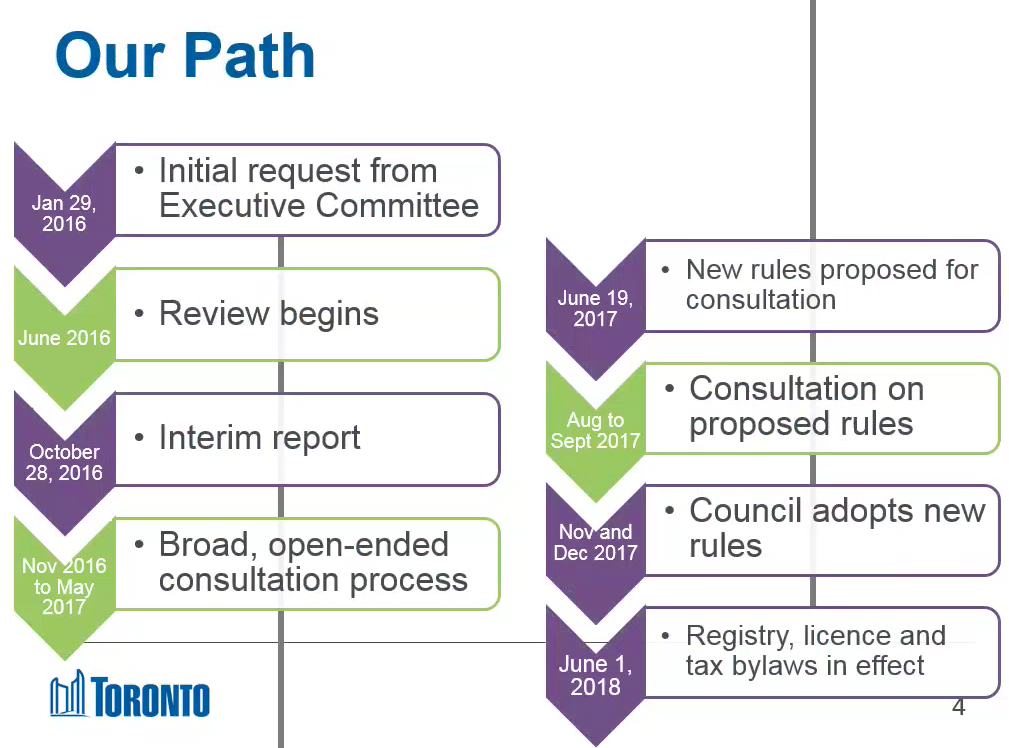

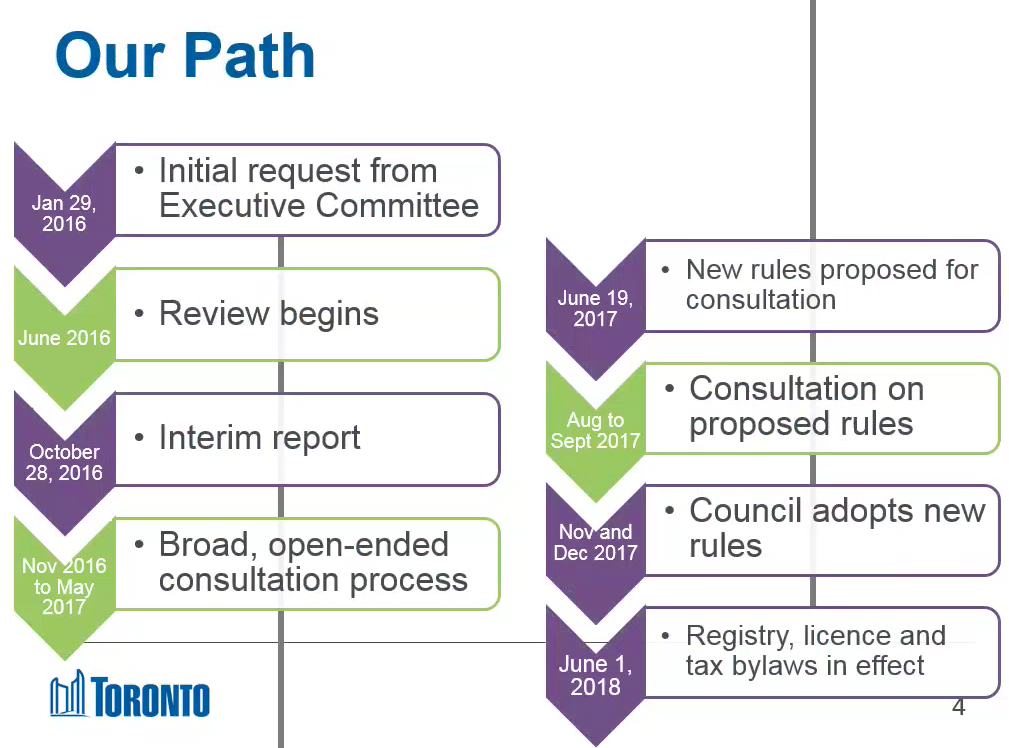

As Airbnb and competing platforms have quickly grown in popularity, the short-term rental market has attracted considerable attention in cities around the world. New forms of mixed-use real estate challenge a variety of existing regulatory structures, from zoning laws to housing codes and tax policies. As Toronto’s city council recently approved a new set of Airbnb regulations, this seminar was hosted by Tracey Cook, Executive Director of Municipal Licensing and Standards in Toronto.

On the 1st of March 2018, city officials from Washington D.C, New York City, Amsterdam, Haarlem, and Montreal participated in our second online seminar to learn from and reflect on Toronto's approach to regulating Airbnb and similar holiday rental platforms. Here are some key take aways from this seminar.

Toronto's Approach

Open opportunities for tourists and the hotel industry - level the playing field.

Enable innovation and still enable inclusion - people can participate and neighbourhoods are not unduly impacted.

Substantial consultations - engaging users of the app (good response rate), which gave us a full breadth of the community's interests and issues with short-term rentals.

Guiding Principles for Regulation

- Allow people to share their own homes

- Minimise negative impacts on housing affordability and availability

- Enable diversity of tourism accommodations

- Maintain community stability

- Minimise nuisance

- Rules need to be fair and easy to follow

The Recording

Watch and listen to the entire online seminar here:

Summary of New Rules

- Simple online registration, potential for ”Pass Through Registration” with companies

- Operators must declare address as their principal residence, meaning where you ordinarily reside

- Corporations cannot have principal residences

- One principal residence per person

- Limit the number of nights rented to a maximum of 180 per year for entire homes while away

- Can share home for unlimited number of nights (up to three rooms)

- Companies must provide data on all short term rental activity they facilitate

- Allow anyone to do short-term rentals in their homeRegister those operating a short-term rental ($50/year)

- License any short-term rental company (like Airbnb, VRBO or FlipKey) ($5000 to apply and $1/night booked)

- Tax those operating a short term rental (4%)

“Its the best time in history to be in government. I love the change. I love the challenge"

- Tracey Cook